Canalys: China PC market shrinks by 1% in Q1, Lenovo still leads the way

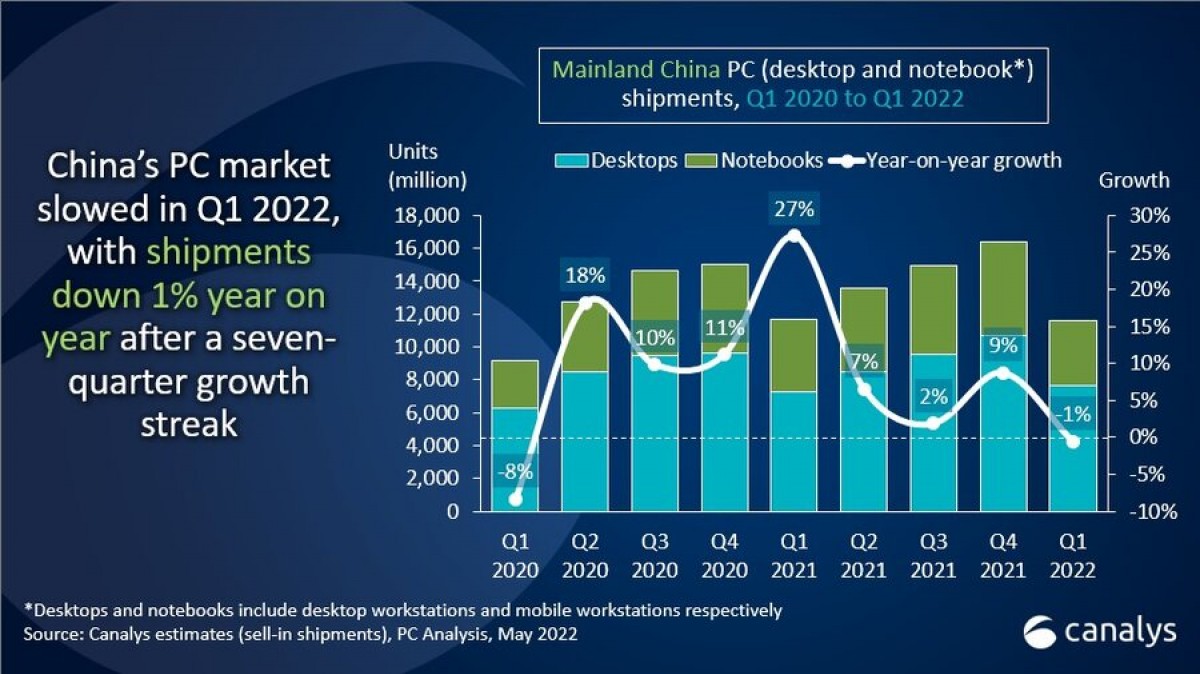

The desktop, notebook and workstation market in China amounted to 11.66 million combined shipments for Q1 which is slightly down from the 11.75 million a year ago according to Canalys’s latest report. Lenovo was the market leader once again with 4.29 million units shipped for the period and a 37% market share. Dell was second with 1.39 million and 12% of the market while HP was third with 0.97 million and 8% market share.

Asus (0.83 million) and Huawei (0.71 million) round out the top five positions. Desktop sales fared even worse with 11% annual drop down to 3.9 million units while notebooks were the only product category to see growth at 7.7 million combined units and 6% market share.

| People’s Republic of China (mainland) PC (desktop, notebook and workstation) shipments and growth, Canalys PC Market Pulse: Q1 2022 | |||||

| Vendor | Q1 2022 shipments (thousand) | Q1 2022 market share | Q1 2021 shipments (thousand) | Q1 2021 market share | Annual growth |

| Lenovo | 4,289 | 37% | 4,276 | 36% | 0% |

| Dell | 1,389 | 12% | 1,295 | 11% | 7% |

| HP | 975 | 8% | 1,132 | 10% | -14% |

| Asus | 833 | 7% | 624 | 5% | 34% |

| Huawei | 710 | 6% | 428 | 4% | 66% |

| Others | 3,462 | 30% | 3,996 | 34% | -13% |

| Total | 11,657 | 100% | 11,750 | 100% | -1% |

| Notes: percentages may not add up to 100% due to rounding Source: Canalys PC Analysis (sell-in shipments), May 2022 |

|||||

The ongoing COVID lockdowns across China put stress on both PC demand and supply. Supply chains were yet again hindered with component shortages in the driver circuit components while rising inflation and weaker consumer spending limited demand for new PCs.

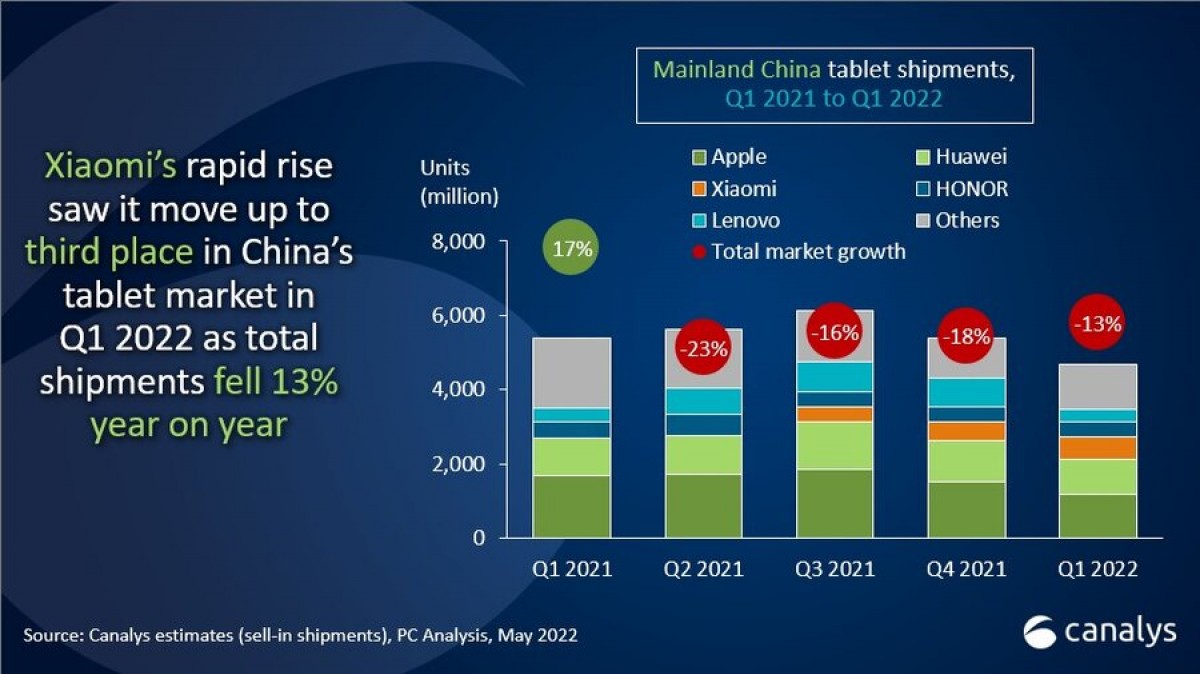

On the tablet side of things, the Chinese market saw a 13% decline in shipments as the demand momentum built up during the pandemic was lost. Apple was the clear-cut leader of the China market with 1.2 million shipped tablets for the period and a 26% market share.

Huawei comes in second place with 0.93 million shipments and 20% of the market while Xiaomi which revived its tablet lineup last year occupied third place with 0.6 million shipments and a 13% market share.

Huawei comes in second place with 0.93 million shipments and 20% of the market while Xiaomi which revived its tablet lineup last year occupied third place with 0.6 million shipments and a 13% market share.

| People’s Republic of China (mainland) tablet shipments and growth, Canalys PC Market Pulse: Q1 2022 | |||||

| Vendor | Q1 2022 shipments (thousand) | Q1 2022 market share | Q1 2021 shipments (thousand) | Q1 2021 market share | Annual growth |

| Apple | 1,200 | 26% | 1,682 | 31% | -29% |

| Huawei | 926 | 20% | 1,037 | 19% | -11% |

| Xiaomi | 600 | 13% | N/A | 0% | N/A |

| Honor | 421 | 9% | 414 | 8% | 2% |

| Lenovo | 320 | 7% | 385 | 7% | -17% |

| Others | 1,223 | 26% | 1,875 | 35% | -35% |

| Total | 4,691 | 100% | 5,393 | 100% | -13% |

| Notes: percentages may not add up to 100% due to rounding Source: Canalys PC Analysis (sell-in shipments), May 2022 |

|||||

Honor was the only brand to see positive yearly growth at 2% while reeling in 0.4 million shipments. Lenovo occupied the fifth spot with 0.3 million shipments and 7% market share. New entrants to the tablet market from the BBK group (vivo, Oppo and Realme) are expected to challenge the established tablet makers in the coming months.

Related

Reader comments

- Anonymous

- 27 May 2022

- 3d6

That's what the elite wants. Recent declarations from wef at davos should be a warning sign for everyone.

- Anonymous

- 27 May 2022

- nbe

This drop in demand is just getting started. 2022 winter will be insane with crazy electricity and energy prices. Nobody will be able to afford anything else but the basics.

- Anonymous

- 26 May 2022

- vG0

I am hoping China just bans X86 and goes all out with RISC-V

Samsung

Samsung Samsung

Samsung Apple

Apple Samsung

Samsung Xiaomi

Xiaomi